In 2024, campground operators, RV park owners, and glamping businesses navigated a year filled with both growth and challenges. From an increase in first-time campers to shifting booking behaviors, understanding these trends is crucial for making informed business decisions.

The 2025 RoverPass Annual Outdoor Hospitality Report compiles exclusive data from thousands of reservations, offering insights into occupancy trends, revenue shifts, and traveler preferences. Campground owners can optimize their business, enhance direct bookings, or plan for expansion with this report’s crucial benchmarks and strategic recommendations.

Key takeaways

- Camping and RV reservations grew by 5% in 2024, signaling continued interest in outdoor travel.

- Short-term stays dominated at 94.2% of bookings, while long-term stays declined slightly.

- First-time campers accounted for 1 in 3 reservations, showing strong new traveler engagement.

- Online bookings led the way, but phone and walk-in reservations increased significantly.

- The average nightly cost for one site in 2024 was $77.70, reflecting a minimal decrease of 0.45% compared to 2023 ($78.05).

A Year of Growth in Outdoor Hospitality

Despite economic fluctuations, the outdoor hospitality industry continued to grow in 2024. Total reservations increased by 5%, showing sustained interest in camping, RVing, and glamping. Travelers sought outdoor experiences, driving demand for both traditional and alternative accommodations.

The growth of campground and RV park owners presents opportunities for them to expand their services, adjust pricing strategies, and refine their marketing efforts. Understanding these shifts can help operators stay competitive and capitalize on emerging trends.

Increased Demand for Outdoor Stays

- Total reservations grew by 5%, reflecting steady interest in outdoor travel.

- Online add-on purchases for firewood, gear, and rental equipment surged 2.5x, boosting revenue beyond site fees.

- One in three reservations came from a first-time camper, showing strong new traveler engagement.

The shift in travel preferences

- Short-term stays (under 21 days) dominated at 94.2%, signaling a preference for quick getaways.

- Tent site bookings grew faster than RV site reservations, reflecting a shift toward budget-friendly stays.

- Luxury accommodations, such as cabins, saw increased demand as more travelers sought comfortable outdoor experiences.

The Evolution of Campgrounds & Business Operations

While the camping industry grew in 2024, the pace of new campground openings slowed by 7.74%. Rising costs and shifting traveler preferences led operators to focus on optimizing existing sites rather than rapid expansion.

To meet changing customer expectations, campgrounds invested in high-demand amenities, alternative lodging, and upgraded services.

Slower Growth in New Campground Openings

- New campground openings declined by 7.74%, reflecting a cautious investment approach.

- One in seven private campgrounds opened in 2024, maintaining a steady but slower pipeline of new outdoor businesses.

How Campgrounds Are Expanding Their Services

- Daily rentals for kayaks, golf carts, and other equipment surged 8x, improving guest experiences and boosting revenue.

- Tent site expansion continued, while RV site expansion declined by 28%, signaling a shift in demand.

Traveler Booking Behavior: Online vs. Manual Trends

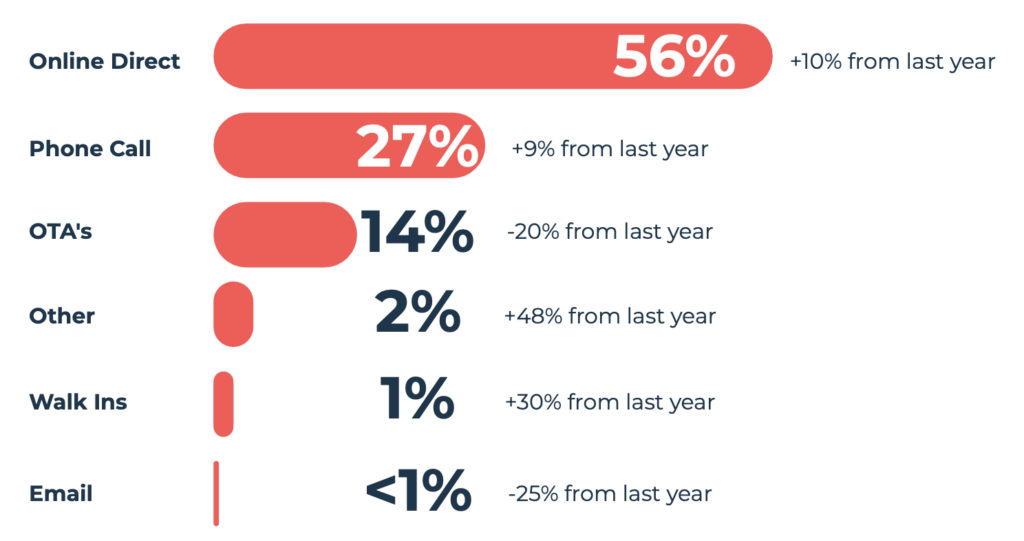

The way travelers book their stays is evolving. While online bookings remain dominant, walk-ins and phone reservations grew significantly. This shift highlights the need for flexible reservation systems that cater to both digital and in-person bookings.

Direct Booking Dominates, But Walk-ins and Phone Reservations Rise

- Nearly 60% of reservations were made directly through campgrounds, reinforcing the trend toward self-service online booking. Direct booking strategies—such as offering exclusive discounts on a campground’s website—helped operators reduce reliance on third-party platforms.

- Walk-in reservations increased by 30%, showing a growing trend of spontaneous travel. Road trippers and last-minute planners contributed to this rise, making it essential for campgrounds to maintain a portion of availability for same-day arrivals.

- Phone reservations grew by 9%, highlighting that while digital bookings dominate, some guests still prefer the reassurance of speaking directly with staff before finalizing a reservation

The Role of External OTAs and Third-Party Listings

- OTA (Online Travel Agency) bookings dropped to 14%, signaling that travelers increasingly prefer booking directly with campgrounds. This shift allows operators to capture more revenue without third-party fees.

- Hipcamp led third-party bookings, followed by Spot2Nite and Airbnb. Campgrounds looking to attract new audiences should consider listing on these platforms while optimizing their direct booking process. However, RoverPass is not considered part of traditional OTAs, so it should be framed separately from these external third-party platforms.

Note: This data does not include native listings from RoverPass or other reservation software.

Cancellations & Rebooking Trends

Managing cancellations effectively can help campgrounds reduce lost revenue and improve occupancy rates. While overall cancellation rates remained steady in 2024, many travelers opted to rebook rather than cancel outright.

When & Why Campers Cancel

- One in six reservations was canceled, consistent with 2023 rates. However, campgrounds with clear cancellation policies and flexible rebooking options retained more revenue.

- 33% of cancellations occurred more than 30 days before check-in, giving campgrounds time to fill those spots with new bookings.

Rebooking After a Cancellation

- 24% of canceled reservations were rebooked within seven days, showing that flexible policies encourage guests to choose alternative dates rather than cancel entirely.

- Campgrounds offering discounted rebooking rates or incentives saw higher retention of guests who otherwise might have booked elsewhere.

Key Revenue Insights for Campgrounds

Beyond site fees, campgrounds expanded their revenue streams through add-on purchases, extended stays, and premium amenities. Understanding guest spending habits helps operators maximize profit.

Increased Spending on Add-ons & Extra Nights

- Add-on purchases rose 66%, with guests spending more on firewood, rentals, and guided experiences. Offering pre-booked add-ons through an online reservation system helped boost sales.

- Extended stay revenue increased by 76%, as travelers booked longer visits, often encouraged by promotional rates for multi-night stays.

Preferred Payment Methods

- Credit cards accounted for 89% of payments, reinforcing the importance of seamless digital transactions.

- ACH payments debuted as a new option, providing flexibility for larger bookings and long-term stays.

Download the Full 2025 RoverPass Report

The insights in this blog only scratch the surface of what the full 2025 RoverPass Outdoor Hospitality Report offers. With exclusive data, expert analysis, and strategic recommendations, the report provides a roadmap for campground success.

What You’ll Get in the Full Report:

- Detailed benchmarks on revenue, booking behavior, and traveler demographics.

- Exclusive interviews with campground operators sharing real-world insights.

- Actionable recommendations to improve booking strategies and guest satisfaction.

Get ahead of the trends and improve campground operations with expert insights by filling out the form to download the full 2025 RoverPass Outdoor Hospitality Report today.

Frequently Asked Questions

1. What is the RoverPass Annual Report, and why is it important?

The RoverPass Annual Report is a comprehensive industry analysis offering data-backed insights into outdoor hospitality trends. It helps campground and RV park owners benchmark their performance, adapt to changing traveler preferences, and refine business strategies.

2. What kind of insights can I find in the RoverPass Annual Report?

The report covers reservation trends, traveler demographics, revenue strategies, and operational benchmarks. It also provides expert analysis and actionable recommendations for growing a successful outdoor hospitality business.

3. How can campground and RV park owners use this report?

Owners can use the report to adjust pricing, optimize site offerings, improve marketing efforts, and increase direct bookings. The data helps businesses stay competitive by aligning their strategies with industry trends.

4. Where does RoverPass get the data for this report?

The report is based on proprietary RoverPass booking data, industry research, and operator surveys. It compiles real-world insights from thousands of campground and RV park reservations across the U.S.

5. How does the RoverPass Annual Report help predict future camping trends?

By analyzing year-over-year changes in traveler behavior, booking preferences, and spending patterns, the report helps campground owners anticipate future demand and make data-driven decisions.